Easy since it imports transaction data from your bank accounts. i’ve used it before (free version) with some success- I didn’t really know what I was doing when setting my budgeting goals, but the app/site was fine for tracking my spending and saving. Mint isn’t really educational but is a common budget tracker tool. Understanding finances, budgeting, etc ADHD style You don’t need to do this manually, check out You Need a Budget or Mint, or google and find a website or example that works for you. With its depth, plethora of options, and convenient report styles, Moneydance for Mac stands out as a. talking about your brand new houses and cars. Moneydance Free Version Moneydance Mac Demo Moneydance is a desktop-based personal finance manager that boasts strong security, online bill pay, and support for multiple currencies (including cryptocurrencies). How the fuck do you people have so much money.

As an example, I use a widget of Mint by. Maybe getting too technical here and I'm by no means a technical expert, but wouldn't you need to be authenticated in order for the app to push that kind of specific info? If the need is quick access to metrics, I'd suggest looking at creating a widget that uses a token authentication rather than having to open up a presumably larger app that needs more resources, etc. See r/mintuit if you want to know more from Reddit, or direct site. Basically does an automatic version of manually copying your bank statements into a XL file and writing your own formula.

Moneydance for mac free version for free#

You can use it for free and it has ability to connect to all your accounts and track transactions, budget, as well as basic goals. Just since you're new, I'll make a small plug for Intuit's Mint budgeting platform. Using Excel to track bank balances, any templates? If you aren't good at tracking your expenses, apps like Mint can do it for you. This will help you see where the money is going, and also draw up a realistic budget going forward.

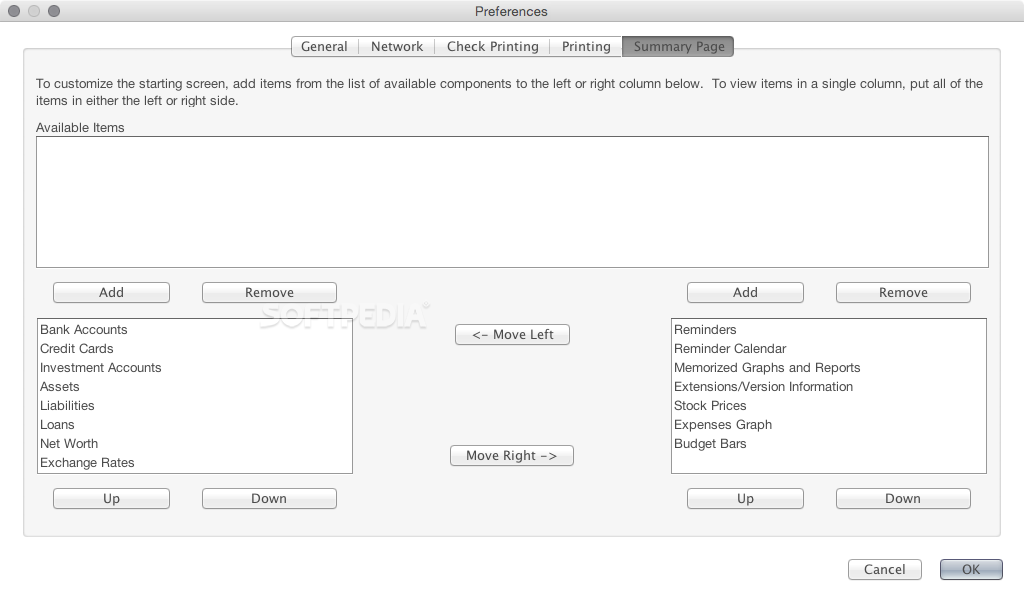

But one thing worth doing in parallel, is to start tracking your expenses. Creating and managing your budget is a breeze, and the reporting options are excellent too, particularly if you're skilled enough to program your own tailored reports.Others have already mentioned good advice on handling debt. By connecting to checking, credit card, investment and loan accounts, Moneydance allows you to stay on top of all your balances and transactions as they occur, and even when you're out and about, with its mobile app. Moneydance delivers top-of-the-line software, offering most of the more advanced money management features that anyone is likely to want. Moneydance offers specialized investment report options, so you'll always know how your investments are performing and will be able to keep tabs on your transactions. The security details also allow you to keep track of stocks. The portfolio overview displays the value of your portfolio, the percent change and cost basis, while the register tracks your trades, including the security, date, stock price, fees and balance. (Image credit: Moneydance) Moneydance review: Investment trackingĪs already mentioned, Moneydance allows the tracking of investments and monitoring of portfolios once you've synced to your brokerage account, and transferred the necessary balances and trades. Should Moneydance not offer a report that you need, experienced programmers can use its scripting support service to help hand write a script in Python that will allow you to analyze your own data and create a custom report based on your needs. That said, the exporting options are fewer than are available at most other services, and you cannot export reports to a tax program. Graphs can be saved as a PNG, and data reports can be saved as an HTML or CSV, which can then be used in other programs, such as Excel. If you wish to save any report you run, you can print a hard copy or save a digital version. You can also choose custom dates for any period of time. Recently I had a client who had been using the ill-fated Quicken Essentials for Mac, and I was surprised to discover that modern Quicken refuses to import its data.

Moneydance for mac free version windows#

The product has always been second class compared to its Windows version. You can adjust the date range, selecting from a number of predetermined options, including year or month-to-date and quarters. Mac users have a long and sordid history with Intuit, the original developers of Quicken. Other reports have charts and graphs for a quick visual of the data, such as the account balances, net worth and an income versus expense report. There are choices for simple data reports, including a budget report, cash flow and income versus expenses.

Moneydance offers some of the best reporting options of all the services we reviewed. If you wish to have the unspent amount from the previous month roll over to the next, you can choose that option as well. And you can individually edit and adjust any category budget you copy over as needed. If your bills and spending habits are similar each month, you can copy the budget you create from one month to the next, saving you time.

0 kommentar(er)

0 kommentar(er)